As someone who has just moved to the UK, do you really need to open a UK bank account? And is opening an account as difficult as people say? Andrew Humphrey investigates.

Your first days and weeks in the UK are hectic. You are starting your new academic life, but you also need to settle in to a new living situation, and cope with the language, the weather, the food, and all the logistics and practicalities of moving to a new country. You need to prioritise. Some things are urgent, and some things can wait.

So when your university issues alarming-sounding instructions to register with the police, the doctor and the bank, it sounds worrying. And it may not feel like a priority:

- "The police? What have I done wrong? Sounds scary. I'll do it sometime soon, if I must"

- "The doctor? I am feeling fine. I will see the doctor when I am ill."

- "The bank? I already have a bank account at home, with online banking, and ATMs here accept my debit card."

Not registering with the police is, for some nationalities anyway, a breach of your visa conditions. Not registering with a doctor could be risky to your health. But not opening a bank account? Does a student who is living in the UK for a year or two, who already has a bank account at home, really need to open a bank account here? As you say, you can manage your existing bank account with online banking, and you can use your credit or debit card everywhere in the UK, both for shopping and for withdrawing cash from any ATM. So why open another account? Especially when you have heard horror stories about how difficult it can be. (It isn’t difficult at all, but I will come to this myth later.)

Do you need a UK account?

A UK bank account is not compulsory for living your life, but it is very useful indeed. Talking to BBC News, a financial analyst went much further, saying it is “almost impossible” to live in the UK without a bank account. Is that true? Well, here are some student essentials that almost always require a UK bank account:

- A mobile phone. If you want a UK number, you can use pay-as-you-go, but if you prefer a contract, you can only pay by direct debit from a UK bank account.

- Paying your bills. Most utility companies will expect you to set up a standing order from a UK bank account to pay your bills.

- Getting paid for part-time and vacation work. Most employers only pay their workers by BACS into a UK bank account.

When you live in the UK, not opening a local bank account is normally reserved for people who are legally prevented from doing so, or who are actively trying to live “off the grid”.

This website includes detailed general guidance on types of bank account, and about the logistics of opening and managing your account. It also includes links to resources from the British Banking Association prepared for specifically for students who are new to the UK, and on finding a Shariah-compliant bank account if that is what you want. See Opening a Bank Account.

Do the banks want me as a customer?

Look around your campus and in the nearby streets during the first week of the semester. You will see all the banks competing to attract student customers. They offer free gifts, gift cards, money, generous overdrafts, and more. But I have bad news for you: almost always, these attractive offers are only aimed at UK students. It may seem unfair but it is a business decision by the bank. As they see it, while in the short term local students may have a small budget and low income, they have graduate earning potential and they may be future customers for credit cards, loans, mortgages and other financial products. A student from overseas does not have this same “customer profile”.

As an international student adviser, students often ask me which is the “best” bank for them. There is no overall best bank but the British Banking Association has produced a guide to basic bank accounts for international students which breaks down the features of basic bank accounts at different banks.

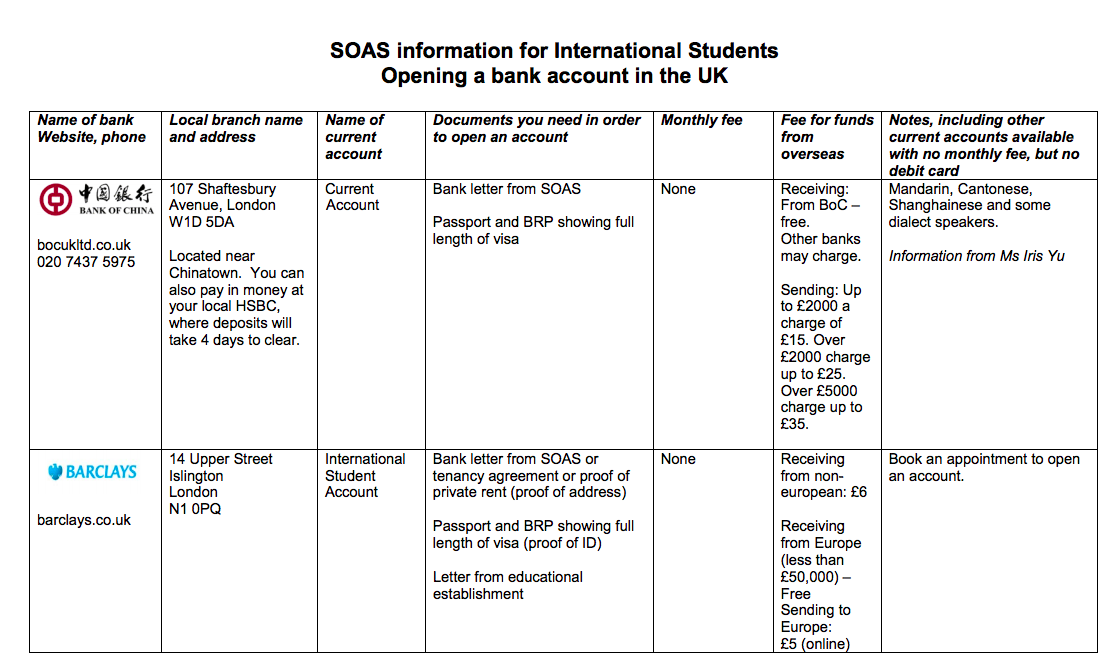

You might want to take this list with a pinch of salt. Not because it is inaccurate, but because the leaflet gives the basic rules agreed by the national head office of the bank. Individual Managers of branches on or near your campus may have different offers for students at your university. For an example of specific local arrangements, see the guide researched every year by the international student adviser at SOAS, University of London, with the accounts available for students in the Bloomsbury area of London.

This information is very specific to one area of one city: ask your international student adviser if there are any special arrangements with the local banks where you are.

Jumping through hoops

You have probably heard people say that an international student needs to jump through hoops to open a bank account in the UK, that it takes weeks to access your money, and that in general the banks seem to not want you as a customer. Years ago, it was indeed a difficult and complicated procedure. You needed utility bills and other evidence which it was almost impossible for a new student to provide. But today it is different. The British Bankers Association and UK universities have worked together to streamline the process. Now you normally need just:

- your personal ID (usually your passport)

- your “Letter of Introduction for UK Banking Facilities” from the university, usually called a bank letter confirming your details

- evidence of your UK address, although if your address is included in the Letter of Introduction, no further evidence may be needed.

You do still need to check with the bank exactly what documents they need from you. The format of the Letter of Introduction and the procedure for obtaining a letter will vary between universities. Often you can request it online. Check directly with your university.

One new bank, Unizest, is aimed specifically at international students as an alternative to the UK banks. Compared to more traditional banks there are advantages (for example, you can open the account before you come to the UK) and disadvantages (your money is not protected by the Financial Services Compensation Scheme).

Whichever bank you choose, I recommend you always DYOR, especially about fees and about how you are protected if things go wrong.

Banking and visas

UKCISA’s guide to opening a bank account explains that immigration and visas do affect some aspects of opening and operating a bank account. Occasionally, banks may be unwilling to unwilling open an account for customers from specific countries, or may even close an account. A couple of years ago some Iranian nationals’ bank accounts were affected by international sanctions. Sanctions were lifted in 2016, but The Guardian reported last year that some bank customers were still having problems.

But one myth I can dispel is that you need a UK bank account to make a visa extension application in the UK. This is not true, nor is it correct that showing evidence of money held in a UK bank account enhances or adds weight to the application. I blogged about this and other myths about Tier 4 money last year.

There is an exception. In one specific scenario it can help to have a UK bank account for a visa extension application. If your money is held in a bank in Bangladesh, Cameroon, Ghana, India, Iran, Pakistan, Phillippines or Sri Lanka, and the bank is not listed as “accepted” in Appendix P of the immigration rules or, worse, if it is “unacceptable”, you should perhaps consider opening an account in the UK.

Cash machine etiquette and tips

After you have opened your bank account, you will probably have minimal contact with the bank. You will normally manage your account through online banking and you will get cash from an ATM, usually called a "cash machine" in the UK. While cash machines are universal, you will find some specific British cultural quirks:

- You can use a cash machine at any bank, not just your own bank. There is no fee to use a different bank’s cash machine.

- Some cash machines which are not affiliated with a specific bank will charge a fee. By law they must warn you on the screen that there will be a fee, and give you a chance to cancel the withdrawal.

- You may find you need much less cash than you think, because it is so easy to pay by card including “contactless” payments for purchases up to £30.

- If there is a queue (line) for the cash machine, people usually form the queue directly behind the person currently using the cash machine. This can feel strange if the etiquette in your country is to form the queue at a distance, to give the current user privacy.

- Most cash machines do not dispense £5 notes, only £10 notes and higher.

- Some machines may give you the choice of withdrawing cash in Euros, but normally this is only around large transport hubs.

- This summer, The Guardian reported that every month around 300 cash machines are closing in the UK. This is because the popularity of contactless card payment for small transactions is reducing the need for cash.

- Most supermarket checkouts function as a cash machine: you can ask for “cash back” when you pay by debit card.

The Money Facts UK website has some good tips about safety when withdrawing cash from a machine. They are good and useful tips, although maybe always taking a friend with you might be impractical and a little over-cautious.

Have you had good or bad experiences with opening a bank account, or with any of the matters covered in this blog? Let me know in the comments. I cannot answer questions asking for individual advice or about specific banks or accounts: those are questions for your international student adviser.

Choose the best bank for you, spend wisely, and have a great 2019!

Andrew Humphrey is an international student adviser and trainer. He hates it when people take a long time at the cash machine.